Sustainable Finance Market Size

Sustainable Finance Market size was valued at USD 5.4 trillion in 2023 and is estimated to register a CAGR of over 22% between 2024 and 2032, driven by growing awareness among government and people regarding environmental and social issues. Globally, governments are stepping up their efforts to support sustainable financing. The impetus behind these initiatives stems from a growing recognition of social and environmental concerns, coupled with an understanding of the pivotal role finance plays in achieving sustainable development goals.

For instance, in September 2023, Singapore and China established a new green finance taskforce to strengthen their bilateral cooperation in green and transition finance. The taskforce, known as the China-Singapore Green Finance Taskforce (GFTF), aims to deepen collaboration between the two countries and facilitate greater public-private sector engagement in sustainable finance initiatives.

Sustainable Finance Market Report Attributes

| Report Attribute | Details |

|---|---|

| Base Year: | 2023 |

| Sustainable Finance Market Size in 2023: | USD 5.4 Trillion |

| Forecast Period: | 2024-2032 |

| Forecast Period 2024-2032 CAGR: | 22% |

| 2032 Value Projection: | USD 31.1 Trillion |

| Historical Data for: | 2021-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 360 |

| Segments covered: | Investment Type, Transaction Type, Investor Type, and End-use |

| Growth Drivers: | Growing awareness about environmental and social issuesIncreasing government and public awareness towards sustainabilityGrowing sustainability regulations globallyRising focus of businesses towards enhancing their goodwill |

| Pitfalls & Challenges: | Diversification issues of sustainable financeEvolving regulatory environment |

The growing awareness about environmental and social issues is also a significant driver of sustainable finance. Investments in social impact initiatives are driven by the awareness of societal injustices, such as poverty, unequal access to healthcare, and differences in educational opportunities. Initiatives that support fair labor practices, increase access to necessary services, foster social inclusion, and improve community well-being are funded by sustainable finance.

Diversification in sustainable finance is a major restraining factor for sustainable finance market growth. Diversification refers to the challenges and considerations related to spreading investment risk across various asset classes, sectors, regions, and impact themes while maintaining alignment with environmental, social, and governance (ESG) principles. Investments in sustainable finance frequently concentrate on particular industries, such as clean technology, sustainable infrastructure, and renewable energy. Though these industries have room for expansion and also support ESG objectives, an excessive concentration in one industry can make a portfolio more susceptible to risks unique to that industry, which may affect that industry.

Sustainable finance Market Trends

Through enhanced data analytics, increased transparency, and easier accessibility to ESG information, fintech innovations are revolutionizing sustainable finance. Blockchain technology makes supply chain finance more transparent and improves the traceability of sustainable investments. Investors may evaluate impact indicators, screen ESG criteria, and interact with stakeholders more efficiently with the help of digital platforms and tools.

Financing climate change initiatives is crucial for mitigating its impact and for making the shift to a low-carbon economy. Capital for carbon reduction programs, climate-resilient infrastructure, renewable energy projects, and adaptation plans is being raised by financial institutions. Examining and controlling climate risks in investment portfolios is increasingly reliant on scenario analysis and climate-related financial reporting.

Based on transaction type, the market is divided into green bond, social bond, mixed-sustainability bond, ESG integrated investment funds, and others. The green bonds segment accounted for a market share of over 36% in 2023. In recent years, there has been a notable surge in growth and innovation within the green bond market. Green bond issuers are broadening the scope of qualifying projects and industries to include sustainable real estate, water management, biodiversity preservation, and climate change adaption. Development banks and financial institutions are actively involved in the structuring of green bond transactions and the creation of financial products that satisfy investor demand.

Green finance is being promoted by governments and regulatory agencies worldwide through frameworks, incentives, and policies. For instance, the EU Green Bond Standard has clearly defined guidelines and requirements stating what constitutes a green bond. This encourages issuers to comply with green finance standards and disclose information on the environmental impact of funded projects, thus encouraging investment.

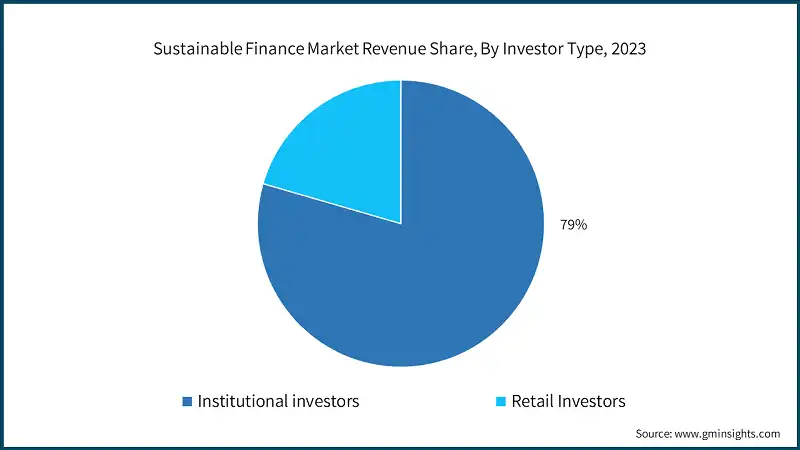

Based on investor type, the sustainable finance market is categorized into institutional investor and retail investor. The institutional investor accounted for a market share of over 79% in 2023. New investment opportunities in developing industries including clean technology, sustainable agriculture, renewable energy, and social impact projects are made possible by sustainable financing. Institutional investors are aware of the potential for expansion and diversification, which is being supported by governmental incentives, technological developments, and shifting consumer tastes.

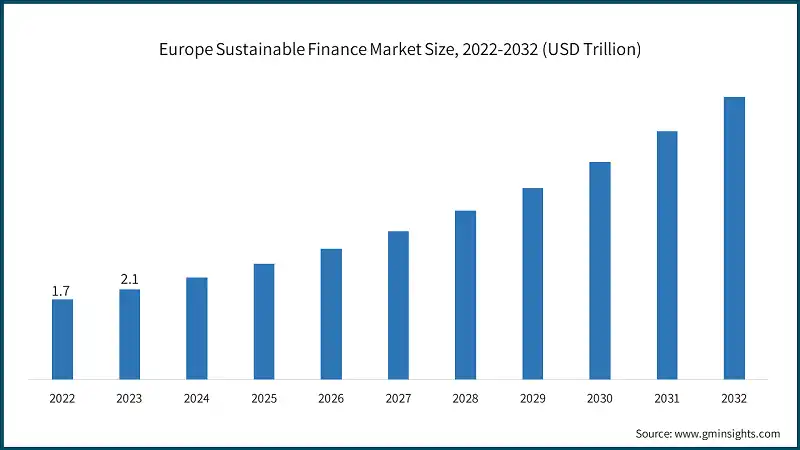

Europe dominated the sustainable finance market with around 39% of the share in 2023. The European Union, as a part of their Green Deal, devised an investment plan in 2020, which aims to deploy investments of at least EUR 1 trillion in sustainable projects over the next decade. Many European institutions are actively investing in developing innovative sustainable finance products and frameworks. This includes impact investing funds, sustainability-linked loans, green bonds, and investment portfolios that have undergone ESG screening. The expansion of sustainable finance efforts is further aided by the existence of specialized green banks and development finance organizations.

Additionally, many European countries like Denmark, Netherlands, United Kingdom, Finland, and Sweden are at the forefront in the sustainability and ESG initiatives. Growing public knowledge of social issues, corporate governance policies, and climate change is resulting in this transition. As a result, there is a sizable sustainable finance market and products that support sustainable development objectives and take environmental, social, and governance factors into account.

Like Europe, North America is also actively investing in sustainability and ESG projects to help combat climate and social issues globally. This includes pledges to improve social governance procedures, increase energy efficiency, and lower carbon emissions. These businesses can access funding options that support their sustainability goals through sustainable finance, like ESG-focused investment funds, green bonds, and loans connected to sustainability.

The Asia Pacific region is facing various environmental issues, such as contamination of air and water, depletion of biodiversity, and the effects of climate change. Governments, corporations, and people in the region are becoming increasingly conscious of the pressing need for sustainable development techniques. Sustainable finance offers capital and investment options to tackle environmental issues, such as renewable energy initiatives, environmentally friendly infrastructure, and sustainable agriculture.

Sustainable Finance Market Share

BNP Paribas, Deutsche Bank AG, Goldman Sachs and HSBC Group hold a market share of 7% in sustainable finance industry. Goldman Sachs and Deutsche Bank AG are major players in the financial sector and have devised various plans to include sustainable financing in their business practices. Goldman Sachs has made significant pledges to sustainable finance, including a promise to raise USD 750 billion by 2030. This pledge includes several projects, including investments in marginalized communities, sustainable transportation, and renewable energy projects.

Deutsche Bank has directed its efforts in sustainable finance, by creating a sustainable finance framework. This framework includes guidelines, practices, and standards for assessing and carrying out transactions using sustainable financing. Like Goldman Sachs, Deutsche Bank actively issues sustainable loans to its clients and issues green bonds. These financial tools provide support for initiatives like sustainable agriculture, clean transportation, and renewable energy that are in line with environmental sustainability goals.

Sustainable Finance Market Companies

Major players operating in the sustainable finance industry are:

- Blackrock

- HSBC Group

- Deutsche Bank AG

- Goldman Sachs

- BNP Paribas

- UBS

- Bank of America

Sustainable Finance Industry News

- In June 2024, Indosuez Funds launched Chronos Green Bonds 2028, a fixed-maturity fund that invests in green bonds issued by companies committed to implementing initiatives aligned with the United Nations’ Sustainable Development Goals. The fund is classified as Article 9 under the EU’s Sustainable Finance Disclosure Regulation (SFDR) and offers a conservative risk profile, ensuring returns while promising a moderate risk.

- In January 2024, the State Bank of India, raised USD 250 million through the issuance of green bonds, which will mature in December 2028. The proceeds from the green bond issuance will be allocated to eligible green projects in accordance with SBI’s ESG Financing Framework. This aligns with SBI’s commitment to sustainable development and creating a positive environmental impact.

Source from: https://www.gminsights.com/industry-analysis/sustainable-finance-market